2020 Census Data Shows Growing Diversity in Johnson County

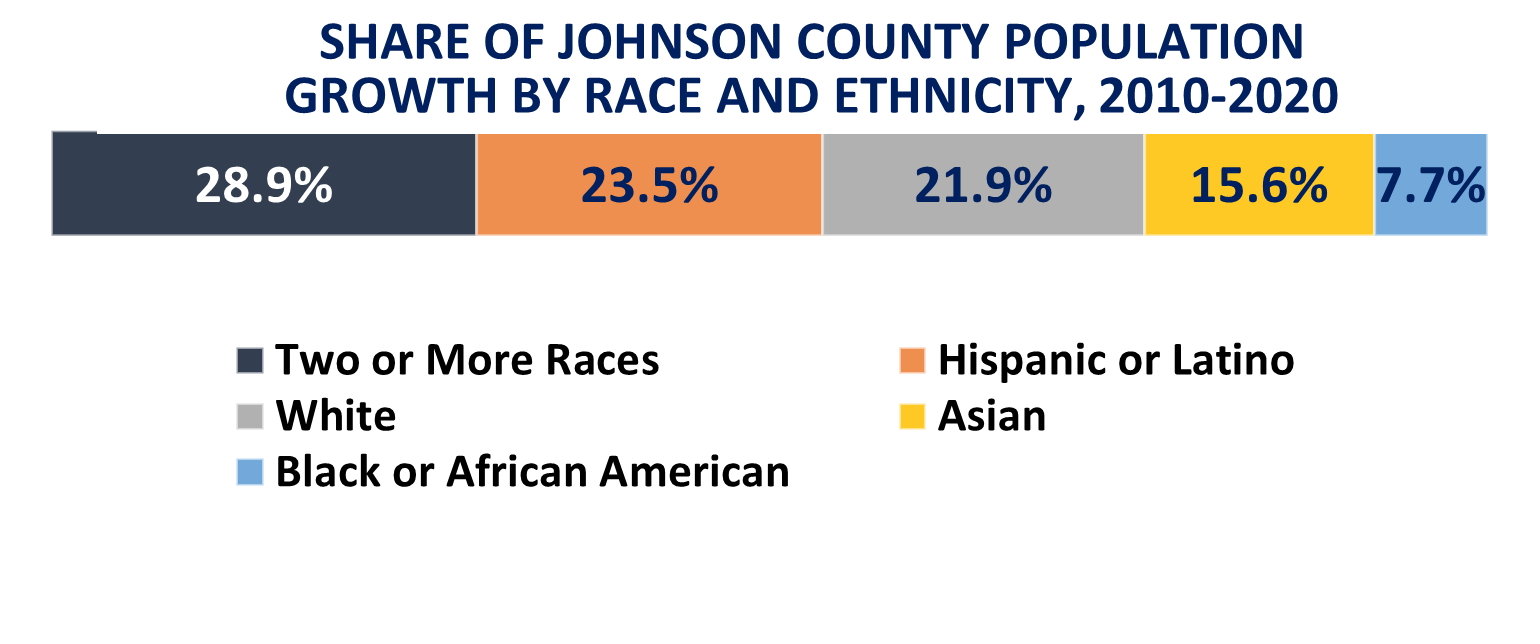

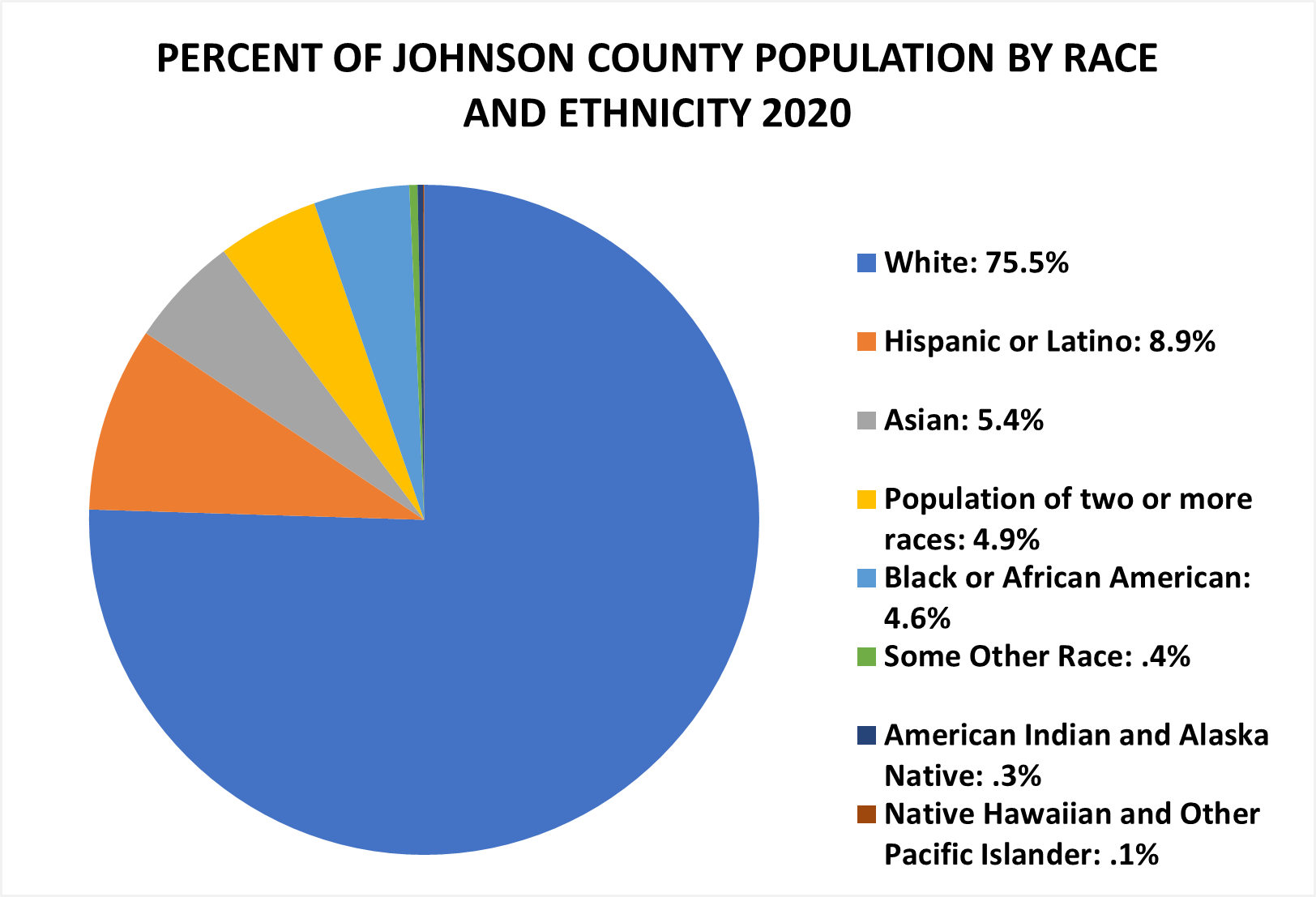

According to the 2020 U.S. Decennial Census results, Johnson County grew by 12% (65,684) between 2010 and 2020, outpacing regional and statewide growth. With that 12% growth, the population of the County has become more diverse. Over the past 10 years Johnson County’s non-white population grew by 51%. Non-white residents now comprise nearly 25% of the Johnson County population—a historic high. White residents, comprising 75.5% of the Johnson County population grew at a substantially smaller rate (3%) than any other racial or ethnic group other than American Indian and Alaska Native, who saw a drop in numbers over the last 10 years. The number of Asian residents in the County increased by over 45%, and Hispanic residents saw a 40% increase.

According to the 2020 U.S. Decennial Census results, Johnson County grew by 12% (65,684) between 2010 and 2020, outpacing regional and statewide growth. With that 12% growth, the population of the County has become more diverse. Over the past 10 years Johnson County’s non-white population grew by 51%. Non-white residents now comprise nearly 25% of the Johnson County population—a historic high. White residents, comprising 75.5% of the Johnson County population grew at a substantially smaller rate (3%) than any other racial or ethnic group other than American Indian and Alaska Native, who saw a drop in numbers over the last 10 years. The number of Asian residents in the County increased by over 45%, and Hispanic residents saw a 40% increase.

The Kansas City Metro Area saw similar trends within a 7% increase overall in population. In the Kansas City Metro, the non-white population grew by 31%, while the White population in the region decreased by just under 1%. The state of Kansas also saw a decrease in the White population, losing just under 108,000, or 5%, of White residents between 2010 and 2020.

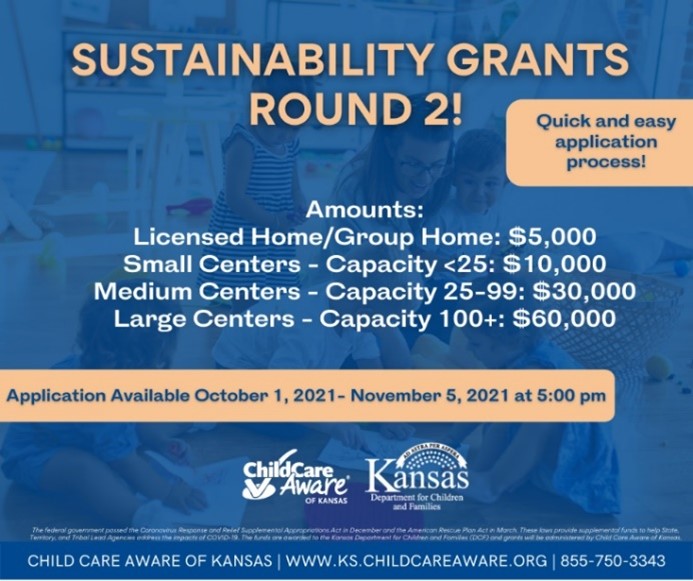

Child Care Sustainability Grants

Child Care Aware of Kansas, in partnership with Kansas Department for Children and Families, is awarding Sustainability Grants – Round 2! These grants aid in continuing operations of childcare programs through the COVID-19 pandemic. All Kansas Department of Health and Environment (KDHE) licensed childcare facilities that demonstrate substantial compliance with KDHE childcare licensing are eligible to apply. Visit the Child Care Aware website for details, FAQs, and a support video.

Child Care Aware of Kansas, in partnership with Kansas Department for Children and Families, is awarding Sustainability Grants – Round 2! These grants aid in continuing operations of childcare programs through the COVID-19 pandemic. All Kansas Department of Health and Environment (KDHE) licensed childcare facilities that demonstrate substantial compliance with KDHE childcare licensing are eligible to apply. Visit the Child Care Aware website for details, FAQs, and a support video.

Dates and Deadlines for 2022 Health Insurance

Open Enrollment for the Affordable Care Act (ACA) for 2022 runs Monday, November 1, 2021–Saturday, January 15, 2022. Enroll by December 15, 2021 for coverage that starts January 1, 2022.

If you still need coverage for the rest of 2021:

- See if you qualify for a Special Enrollment Perioddue to a life event, like losing other coverage, moving, getting married, or having a baby. You may also be able to enroll now if you got or were approved to get unemployment compensation in 2021. (The Marketplace will follow up with you shortly after you submit your application if you’re eligible for this Special Enrollment Period.) If eligible, you may qualify for help paying for coverage, even if you weren’t eligible in the past. Learn more about lower costs.

- See if you qualify for Medicaid or the Children's Health Insurance Program (CHIP). You can apply for these programs any time.

Need Child Care Assistance?Need Child Care Assistance?

In an effort to improve access to quality, affordable childcare, more Kansas families will now have access to a new round of assistance through the Hero Relief Child Care Assistance Program. Any Kansas worker who makes 250% or less of the federal poverty level is now eligible for childcare assistance. The expansion also includes waiving the family share deduction for essential workers and reducing the deduction for all others. Families also will see an expanded eligibility period from six to 12 months.

In an effort to improve access to quality, affordable childcare, more Kansas families will now have access to a new round of assistance through the Hero Relief Child Care Assistance Program. Any Kansas worker who makes 250% or less of the federal poverty level is now eligible for childcare assistance. The expansion also includes waiving the family share deduction for essential workers and reducing the deduction for all others. Families also will see an expanded eligibility period from six to 12 months.

***Those who may have applied for assistance but were denied due to income qualifications are urged to reapply due to the increase in income qualifications.

For more information and for instructions on how to apply, visit www.KSHeroRelief.com.

Expanded Child Tax Credit

The Internal Revenue Service has started sending letters to more than 36 million American families who, based on tax returns filed with the agency, may be eligible to receive monthly Child Tax Credit payments starting in July.

The expanded and newly-advanceable Child Tax Credit was authorized by the American Rescue Plan Act, enacted in March. The letters are going to families who may be eligible based on information they included in either their 2019 or 2020 federal income tax return or who used the Non-Filers tool on IRS.gov last year to register for an Economic Impact Payment.

Families who are eligible for advance Child Tax Credit payments will receive a second, personalized letter listing an estimate of their monthly payment, which began July 15.

Most families do not need to take any action to get their payment. To learn more, visit the IRS website.

Rental and Utility Assistance Available for Johnson County Residents

Kansas Emergency Rental Assistance (KERA) has over $18 million in funds for rental and utility assistance available to support Johnson County residents. Households can be eligible for up to one year of rental assistance (past due or future) and/or up to one year of late/past due utilities.

Apply online: https://kshousingcorp.org/emergency-rental-assistance/.

If you need help filling out the application, please call or email any of these agencies:

- Jewish Family Services: (913) 327-8250, E-mail: info@jfskc.org

- Catholic Charities - Overland Park: (913) 384-6608, 9806 W 87thSt, Overland Park KS

- Catholic Charities – Olathe: (913) 782-4077, 333 E. Poplar St., Olathe KS

- Salvation Army – Olathe Corp: (913) 782-3640 - ask for social services; 420 E Santa Fe, Olathe KS

- El Centro: (913) 677-0100, Website: Contact Us | El Centro

To be eligible, households:

- must be renting,

- make less than 80% of Area Median Income (for example, $61,950/yr for a family of 3),

- at least one member of the household must be experiencing a financial hardship directly or indirectly related to the COVID-19 virus (loss of employment, medical costs related to COVID, childcare costs, etc.),

- at least one member of the household must have late or past due rent or utilities.

For utility assistance, households can apply directly for assistance through KERA and, if approved, utility providers will be paid directly. Utility assistance includes overdue utility charges, disconnect and reconnect fees.

For rental assistance, there are 2 parts to the application: one that the household/renter fills out and one that the landlord fills out. You can fill these out at the same time or separately. Rental assistance can be for back rent AND new rental charges. Payments are made directly to your account with your landlord.

For more information, please see this flyer.