Racial Equity and the Role of Homeownership – Editorial

UCS has long advocated for economic stability policies that support the well-being of our community and provide people with the opportunity to achieve their individual potential. But what should advocacy look like for community members who have been prevented generationally from achieving their individual potential due to a history of systemic racism and segregationist polices?

One example of these discriminatory policies traces its roots back to our local community. The Johnson County landscape was drawn in the early 20th century, when federally sanctioned segregation in home loans and housing choice restricted Black families from building wealth through home ownership. Local and national homeownership data demonstrate the extent to which these past policies still impact the health and well-being of today’s residents. Kimberly Amedeo explores how the racial homeownership gap overlaps the racial wealth gap in her article “Home Equity and the Racial Wealth Gap” in The Balance. Richard Rothstein’s Color of Law argues that the government’s housing and lending policies created a structural inequality we are still working to overcome.

Last year, the American Medical Association recognized that racism negatively impacts and exacerbates health inequities among historically marginalized communities. The AMA went on to state that without systemic and structural-level change, health inequities will continue to exist, and the overall health of the nation will suffer. The conditions in which we live, work, play and worship affect the quality and length of our lives and are referred to as the social determinants of health.

UCS’ guiding principles are based on the belief that all individuals and entities contribute to and share responsibility for the common good. To me the best way we can honor Black History Month is to marshal our shared responsibility to listen, learn, and act on necessary structural change. As we aspire to embody our state motto Ad Astra per Aspera (to the stars through difficulty), let us remember it was coined by Free-State advocate, John James Ingalls, during a time when Kansas was the epicenter of who we would ultimately become – a nation of enslavement or freedom.

Julie Brewer

Executive Director

United Community Services of Johnson County

Outcomes for Black Residents in Johnson County

United Community Services has prioritized a critical need for greater awareness, analysis, and action with regards to racial equity, defined as the condition where one’s race identity has no influence on how one fares in society. Racial equity is key to achieving health equity. Inequities in health outcomes can be due to unjust, unfair, or systemic differences due to ethnicity, race, age, ability, or geography. This profile of Black residents in Johnson County provides a snapshot of some of the key determinants of health within the county’s Black community.

Black residents make up 4.7% of the Johnson County population. Out of a history of residential segregation that built the suburbs, today more than 27,700 Black people call Johnson County home. The Johnson County landscape was drawn in the early 20th century, when federally sanctioned segregation in home loans and housing choice restricted Black families from building wealth through home ownership and seeking opportunity for their children through quality public education.

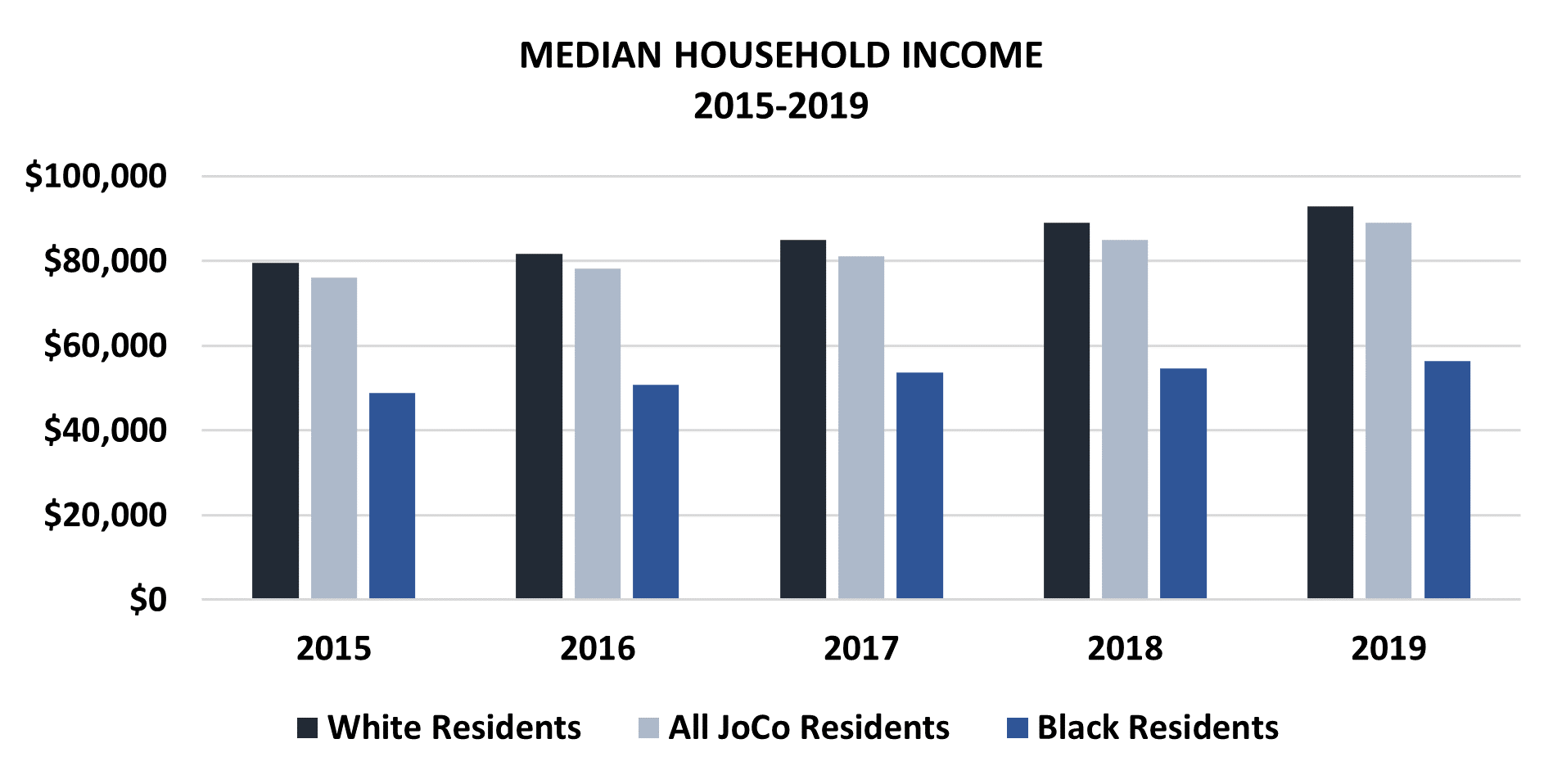

Median household income for Black households in Johnson County was $56,420 in 2019, which was 63% of the median income for the county as a whole ($89,087) and 61% of the median income for white residents ($92,869).

Jurisdictions Allocate More Than Two Million in Alcohol Tax Fund Grants to Area Programs

Congratulations to the 2021 Alcohol Tax Fund grantees! These grantees worked to be flexible in 2020 to adapt services and service mechanisms to provide substance abuse education, prevention, intervention, treatment and recovery during the global coronavirus pandemic.

Johnson County and 9 cities* committed $2,024,220 for the 2021 Alcohol Tax Fund; this is ~6% decrease from 2020 commitments and is due to a concomitant reduction in collection of by-the-drink taxes as bar and restaurant dining was limited in 2020 due to the pandemic.

Alcohol Tax Funds are allocated based on the recommendations of the Drug and Alcoholism Council (DAC) of Johnson County, which comprises volunteers from each jurisdiction contributing to the Fund as well as community volunteers representing a breadth of experience related to substance abuse. The 2021 Alcohol Tax Fund will be utilized by 25 grantees to provide critical programs and services intended to provide substance abuse education, prevention, intervention, treatment, and recovery for Johnson County residents. Click here for the full recommendations report.

UCS also recognizes the work of the 2021 DAC in reviewing applications and making recommendations for funding: Chief David Brown, DAC Chair; Liana Riesinger, DAC Vice Chair; Jill Grube, DAC Secretary; Jen Jordan-Spence, Grant Subcommittee Chair; Jamie Murphy, Grant Subcommittee Chair; Afam Akamelu, Jason Bohn, Judge Jenifer Ashford, Michelle Decker, Allison Dickinson, Captain Troy Duvanel, Bradford Hart, Stefanie Kelly, Dr. Martha LaPietra, Councilperson Piper Reimer, Sharon Morris, Bureau Chief Daryl Reece, Pastor Kevin Schutte, Catherine Triplett, and Charlene Whitney. Thank you!

*Gardner, Leawood, Lenexa, Merriam, Mission, Olathe, Overland Park, Prairie Village, and Shawnee