KanCare Expansion Could Provide Health Insurance Coverage to Thousands in Johnson County

The 2022 Kansas legislative session provides an opportunity to expand Medicaid, which would provide health insurance coverage to thousands of people across the state of Kansas. Kansas is now one of only 12 states that has opted not to expand Medicaid. Approximately 34,500 people in Johnson County, or 6% of the county’s population, is uninsured. Based on U.S. Census Bureau data for 2019, 30% of those who are uninsured would qualify for Medicaid if expansion were approved by the Kansas Legislature. More than 10,300 uninsured Johnson County residents would receive coverage.

In Johnson County, health insurance rates vary by demographic group. People of color are more likely to be uninsured than White residents. The uninsured rate for Black residents (12.5%) is more than three times the uninsured rate for White residents (3.9%). Twenty-two percent of Latino residents are uninsured. Lack of health insurance exacerbates health disparities in communities of color. Being uninsured has been correlated with poorer quality of health care, lower rates of preventive care, and greater probability of death. Many uninsured people avoid seeking medical care unless they are faced with an emergency, or they delay care until their symptoms become intolerable. As a result, the uninsured are less likely to receive a diagnosis in the early stages of a disease, experience poorer medical outcomes following accidents or sudden conditions, and are less likely to schedule regular visits with physicians and to get effective treatments like prescriptions.

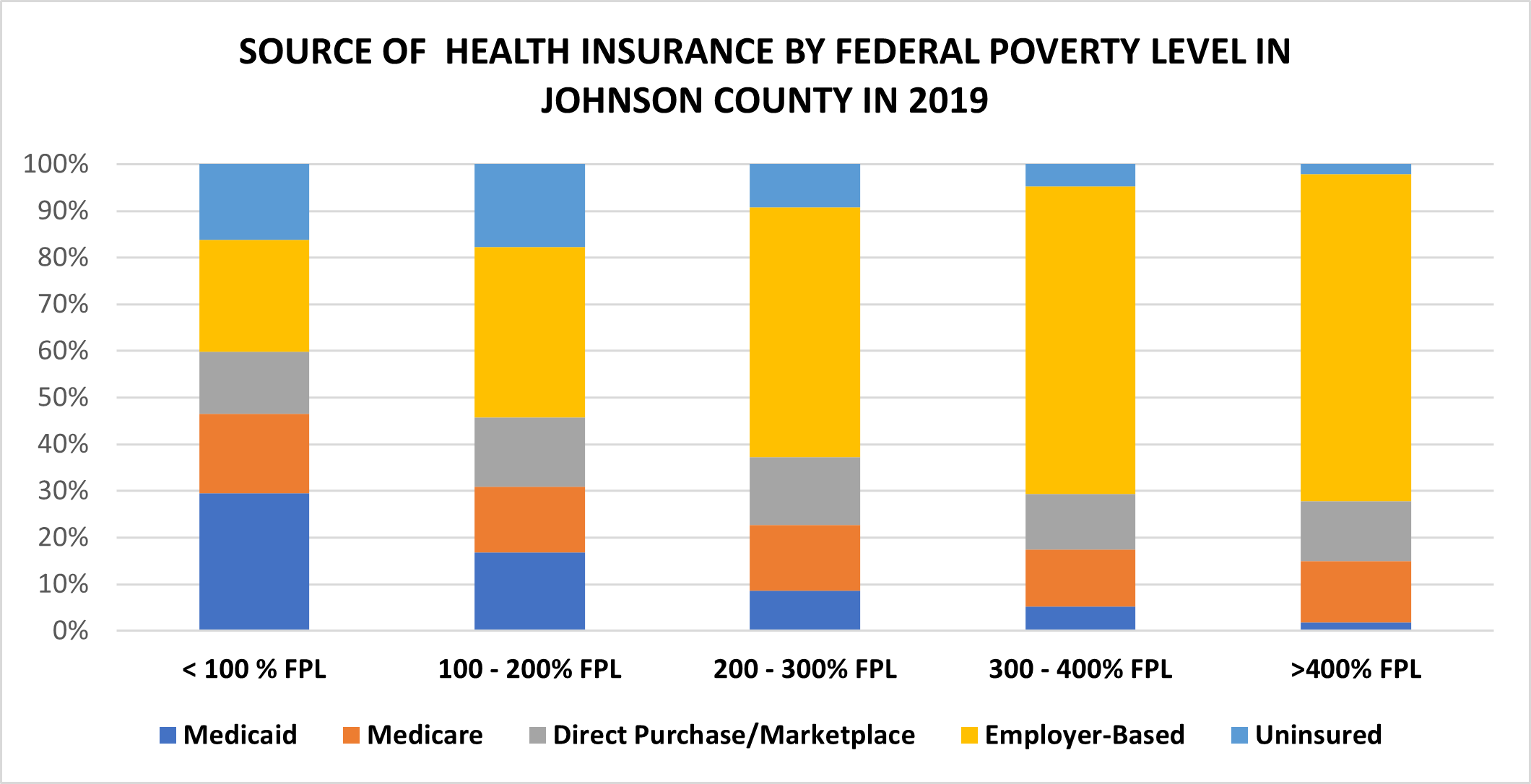

Most people in Johnson County who have health insurance receive coverage through their employer. Others purchase insurance directly on the marketplace, such as the health insurance exchange created by the Affordable Care Act (ACA). As of 2022, more than 14 million Americans have signed up to get health coverage through Affordable Care Act insurance marketplaces, eclipsing the previous record enrollment by nearly 2 million. While most people only have one form of health insurance coverage, 14% of residents have two or more forms of insurance coverage.

Currently, only 5% of residents with health insurance have Medicaid coverage. In Kansas, federal Medicaid dollars are administered through the program known as KanCare. KanCare eligibility currently provides no coverage options for adults without a disability and without children under the age of 18, or for adults with children who make more than 38% of the Federal Poverty Level (FPL). Thirty-eight percent of poverty for a family of three is an annual income $8,334. At the same time, the Affordable Care Act (ACA) Marketplace only offers premium tax credits to households earning between 138% and 400% of FPL, or $30,304 to $87,840 per year for a family of three. Thus, there is a coverage gap for some of Johnson County’s lowest income residents—those who make too much to qualify for KanCare, and those who do not make enough to afford a Marketplace plan without the help of a subsidy.

Currently, only 5% of residents with health insurance have Medicaid coverage. In Kansas, federal Medicaid dollars are administered through the program known as KanCare. KanCare eligibility currently provides no coverage options for adults without a disability and without children under the age of 18, or for adults with children who make more than 38% of the Federal Poverty Level (FPL). Thirty-eight percent of poverty for a family of three is an annual income $8,334. At the same time, the Affordable Care Act (ACA) Marketplace only offers premium tax credits to households earning between 138% and 400% of FPL, or $30,304 to $87,840 per year for a family of three. Thus, there is a coverage gap for some of Johnson County’s lowest income residents—those who make too much to qualify for KanCare, and those who do not make enough to afford a Marketplace plan without the help of a subsidy.

Learn more about KanCare Expansion and the impact it could have for Kansas residents here.

Tax Credit Information for HUD Assisted Individuals and Families

The Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) are large tax refund payments that people can receive when they file a tax return. The 2021 American Rescue Plan (ARP) expanded who can receive these payments and increased the amount of money available to many families and individuals. These tax credits are not income. Receiving these benefits will not impact eligibility for other federal benefits. The best way to receive these benefits is to file a tax return before April 18, 2022.

Service providers can support their clients in receiving these tax credits by:

- Making sure clients are aware of the credits. See the IRS Toolkit, one pagers and flyersfor more information on both tax credits and easy to share resources.

- Connecting clients to free tax filing support online or via IRS Volunteer Income Tax Assistance (VITA) program centers.

Hometown Grants by Evergy

Evergy is offering a new, limited-time grant opportunity of up to $10,000 for an idea or project that can Spread Good Energy in our community. Submit a completed application online between February 15 - March 4 by visiting this link. Here are just a few examples of potential projects: improve a community space that helps vulnerable and underserved populations; host an environmental project such as a park and trail improvements; and design a program to help stimulate workforce readiness or youth development.

Evergy is offering a new, limited-time grant opportunity of up to $10,000 for an idea or project that can Spread Good Energy in our community. Submit a completed application online between February 15 - March 4 by visiting this link. Here are just a few examples of potential projects: improve a community space that helps vulnerable and underserved populations; host an environmental project such as a park and trail improvements; and design a program to help stimulate workforce readiness or youth development.