Kansas Housing Resource Center Launches Mortgage Relief Program

Kansas Housing Resources Corporation (KHRC) this week launched the Kansas Homeowner Assistance Fund (KHAF), providing mortgage and utility assistance to Kansas households impacted by the COVID-19 pandemic. The program, supported through funding from the federal American Rescue Plan Act (ARPA) and administered by KHRC, will help qualifying Kansans get current on their mortgages and property taxes and avoid foreclosure.

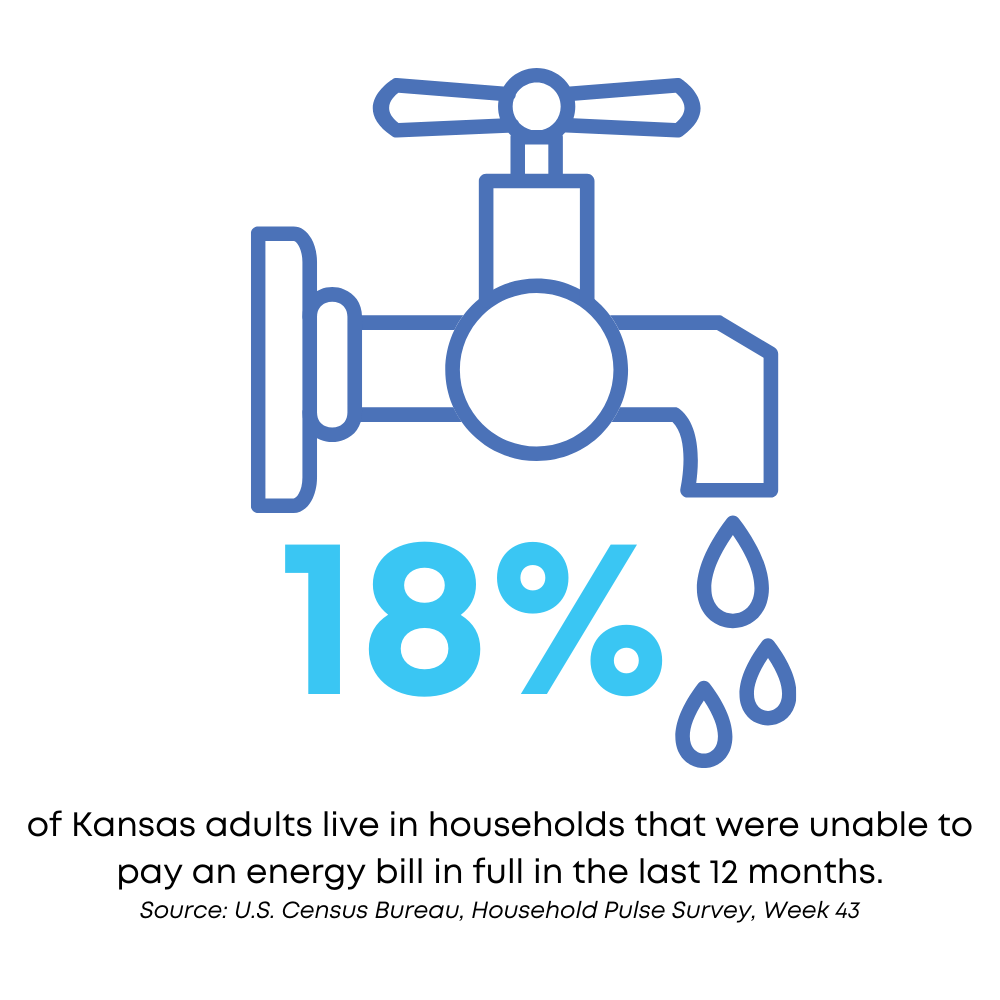

In an interview with the KHRC staff last week, UCS learned more about how and why this project was created. In its more than 20-year history, KHRC has administered programs to sustain housing and meet diverse housing needs across the state of Kansas. The housing needs are indicated in the Statewide Housing Needs Assessment released in December, but this report does not capture the true impact of COVID-19 on the housing needs and challenges of Kansans. According to Executive Director Ryan Vincent, the pandemic effect of “the last two years have made a problem into a crisis.” The pandemic was disruptive to both renters and homeowners as their work hours and income reduced, but costs of childcare, healthcare and food remained high. While federal eviction moratoriums and loan forbearance orders kept this crisis at bay, KHRC was still receiving calls from renters and homeowners beginning early in the pandemic with requests for referrals to resources such as legal services and housing counseling.

The Kansas Emergency Rental Program (KERA, formerly the Kansas Eviction Prevention Program) was established in 2020 with CARES Act funding from the federal government to prevent eviction by providing rent for up to 18 months (including back rent, utilities, and internet). “People are months and months behind, so far in debt,” said Laurie Fritz, Director of Quality Assurance. “We are covering living costs so that people can keep their housing and spend on other priorities.” The KERA program has had a life-changing effect on renters across the state. KERA applications are open and can be processed in 3-4 weeks. As of April 1, more than 6,600 applications have been funded in Johnson County and more than $34.2 million has been paid to support Johnson County renters.

Calls from homeowners to KHRC have increased over time as lenders demand payment on overdue mortgages. “People who have never sought assistance before are calling to get assistance with their mortgage and with property taxes,” says Marilyn Stanley, KHAF Program Director. “By the time they come to us, they've already exhausted all loan relief service options with their lenders.”

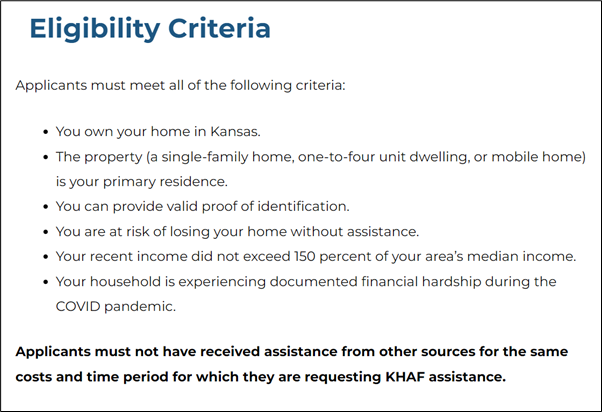

Thanks to the Kansas Homeowner Assistance Fund (KHAF), all eligible Kansans who are behind on mortgage payments due to financial hardship can receive assistance. Additionally, those behind on property taxes, homeowner association fees, utilities, or internet/broadband payments due to financial hardships can receive assistance. Financial hardship is defined as a loss in income or an increase in expenses that is somehow related to the COVID pandemic. The KHAF program is funded through the federal American Rescue Plan Act. Governor Laura Kelly designated Kansas Housing Resources Corporation (KHRC) to serve as the administrator of most of these funds through the KHAF program. Homeowners apply through an online process. If the application is approved, the KHAF funds are sent and applied directly to homeowners’ accounts, helping homeowners receive aid as quickly as possible.

"Because of this program, a large number of Kansans will not lose their home or have to experience the trauma and disruption that comes to families and communities when there are foreclosures,” says Mr. Vincent. "Our hope is that we will continue making a home for people here in Kansas.”

Approximately $57 million is available in the Fund. Due to the high need, funds are expected to go quickly.

KHAF Application Assistance is Available

Agencies are highly encouraged to connect potential KHAF applicants to Habitat for Humanity, which can provide application assistance and mortgage counseling, as needed. Reach out directly to:

Shawn Brantley

sbrantley@habitatkc.org

816-924-1096 X 1041

or

Kylie Navarro

knavarro@habitatkc.org

816-924-1096 X 1040

Upcoming Webinar on May 3: Expanding Access to Homeownership Resources to the Underserved in Kansas

The Federal Deposit Insurance Corporation (FDIC) and the U.S. Department of Housing and Urban Development (HUD) will host a webinar to support equitable homeownership opportunities and wealth-building in underserved communities. The event will increase awareness and access to recent homeownership funding and resources. In addition, it will promote collaboration between banks and affordable housing community organizations, highlight affordable home ownership programs, and provide resources that banks and community organizations can use to support the underserved including Black, Indigenous, and People of Color communities. Presenters will share information on housing programs and resources, bank referrals of homeowner programs, and provide assistance to access housing resources. Attendees will also learn about collaborative opportunities to partner with organizations committed to housing opportunities that support economic inclusion.

Register here.

Announcement: Networking and Training Event for Planning Commissioners

UCS is partnering with the Mid-America Regional Council to offer two networking and training sessions for planning commissioners in May. One session will be held in Missouri (May 10, 2022) and one in Kansas (May 12, 2022). These interactive sessions are designed for local planning commissioners to network with peers in other communities and learn more about housing challenges and opportunities. The event features a hands-on mock plan review of a residential development. Click here or contact gti@marc.org for more information or to register.