All prospective attendees must RSVP directly to Christina Ashie Guidry, christinag@ucsjoco.org, by Monday, May 10. Please provide your name, title, and affiliated agency. After May 10, Ms. Guidry will send final meeting details, including the link to the virtual meeting and application and RFP materials, directly to those who have RSVP'ed.

UCS administers the Alcohol Tax Fund allocation process for the jurisdictions that collect the tax, recommending funding for local organizations to support substance abuse treatment and prevention programs. The ATF supports programs that provide alcohol and substance abuse prevention, education, detoxification, intervention, treatment and recovery in accordance with KSA Section 79-41a04 (as amended). Applicants must be either recognized by the IRS under Section 501(c)(3) and provide health and human services programming as their primary mission, and be in good standing in Kansas or Missouri as a nonprofit corporation; or be a program of Johnson County, Kansas Government, the 10th Judicial District Court, or a Johnson County public school district.

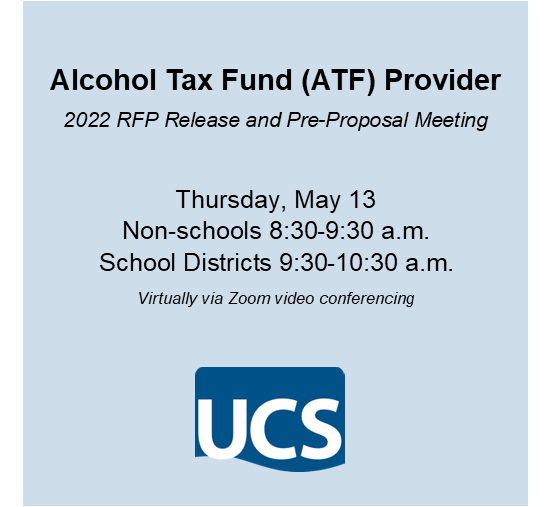

A pre-proposal meeting for 2022 Alcohol Tax Fund (ATF) grants will be held virtually on May 13, 2020 from 8:30-10:30 a.m. The 2022 ATF Request for Proposal (RFP) and application will be reviewed from 8:30 to 9:30 for non-schools, and from 9:30 to 10:30 for public school districts. The 2022 ATF RFP and grant application will be released a few days prior to the meeting. For 2022 ATF Funding Priorities, click here.

ATF funding priorities are approved by the Drug and Alcoholism Council annually. Priorities approved for 2022 are based upon priorities developed in 2018 through a formal planning process that included input from key stakeholders, review of current literature, and analysis of indicator data in Johnson County. For the report from the 2018 planning process, click here.